The custom rate quote experience has been modernized to effectively convert more leads. It seamlessly integrates with your pricing engine to offer personalized rate quotes.

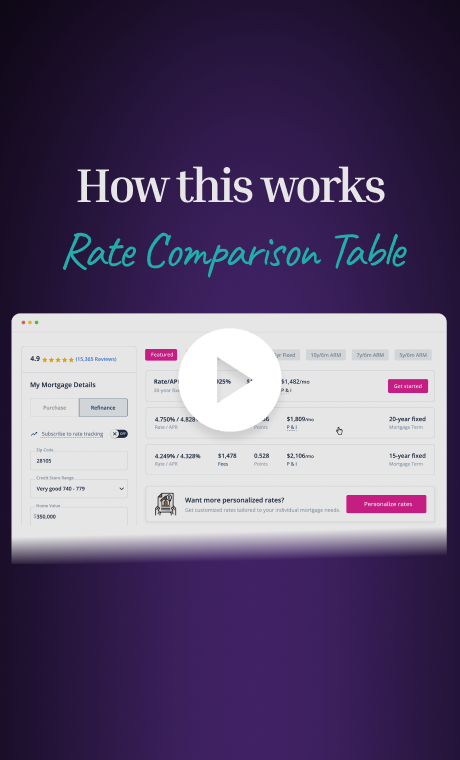

Enable prospective home loan shoppers to rely on your website as a dependable resource to compare loan options, price points, and associated costs in a single platform.

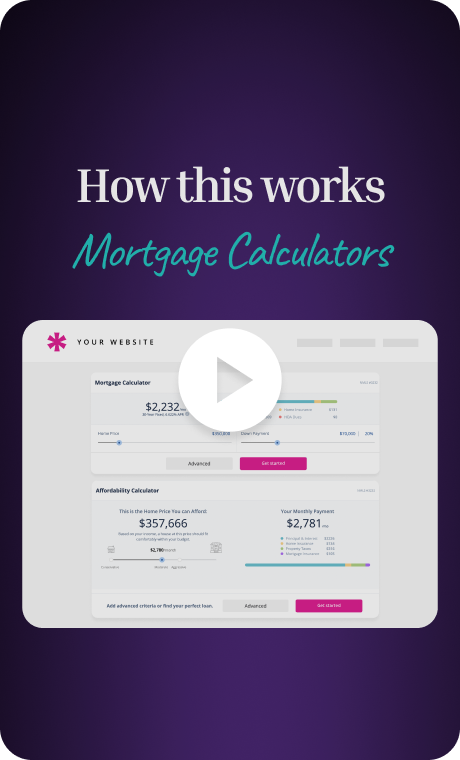

Offer a suite of calculators that are engaging and user-friendly, and can be easily accessed from any device. These calculators will enhance your brand's reputation as a trusted advisor.

Achieve maximum engagement with potential mortgage leads through a tailored, real-time rate dashboard that offers a personalized experience, compelling them to return.

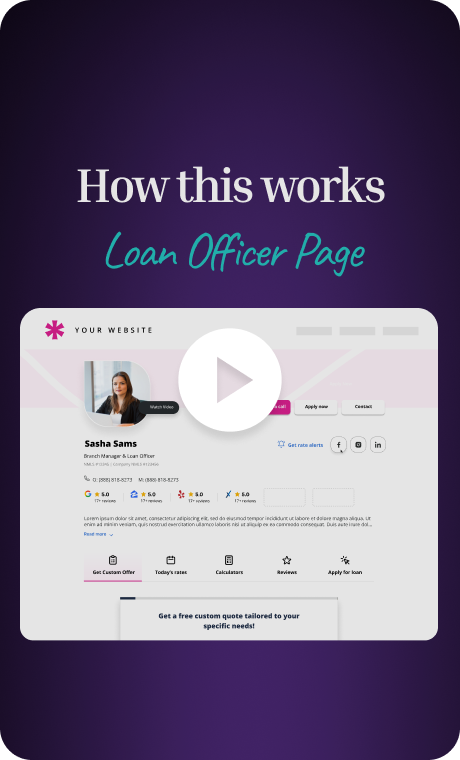

A professionally designed webpage that combines all BankingBridge features into one page. By including custom rate quotes, comparison shopping, calculators, and reviews, your loan officer can establish themselves as a reliable and trustworthy source.

.svg)

.svg)

.png)

.svg)

.svg)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.svg)